The Shale of Silicon without the Boom

I've been obsessed with CoreWeave. It's not the 173x return that Magnetar made on their $4mm convertible investment from 2021 that interests me.

It's their debt.

The debt structure is so magnificently unique. I've found immense joy in understanding it in detail, elucidating the inner workings that drive its variable interest rates and potential covenant triggers. More than anything, though, I find it incredible that a startup pulled off a deal like this.

Taking a deep dive into CoreWeave's debt reminded me of my days as an oil and gas analyst.

A lot of upstream E&Ps typically operate with significant leverage. They need to continue drilling and pour significant capital to just maintain oil production (oil wells decline in production after an initial peak that occurs 1–3 months after production starts). They were levered to the gills (on a debt to EBITDA basis) when oil prices were low. Covenants would often need to be renegotiated.

This also meant tons of companies went bust if negotiations failed. Seemingly minor hiccups (like impurities in a well that drove post-processing costs up by a few bucks) could push them over the edge. The name of the game was to hold on for dear life in these situations. (It was quite painful to see a company in my PA go bankrupt and wipe out my equity, only to reemerge a year or so later. Fun times.)

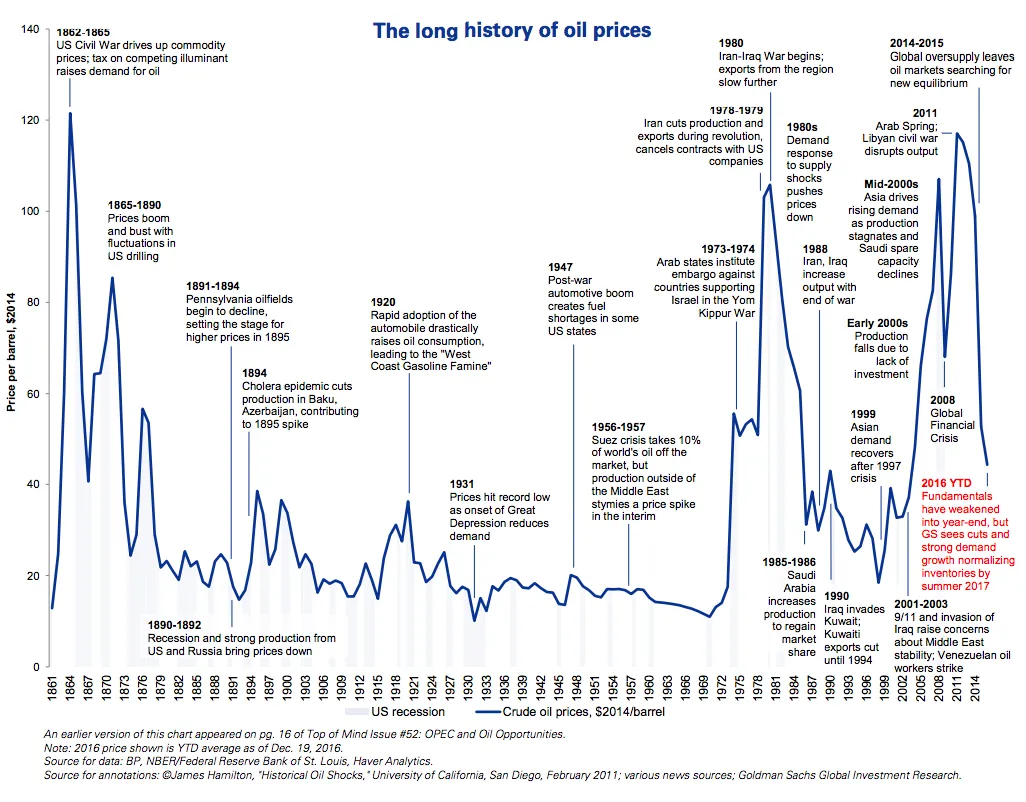

The parallels to CoreWeave are striking. It’s a different product, sure, but the financial dynamics feel oddly familiar. GPU data centers feel similar in their risk profile: A CAPEX-heavy business with fluctuating end-product prices. The key difference is that GPU compute prices have been on a continuous downward trend, whereas oil prices move up and down.

Perhaps there will be some massive boom in a particular sector that drives demand and in turn, GPU compute prices up. Maybe it’ll be something related to AI or maybe a use case we haven’t even imagined yet. But as of today, there’s no sign of a boom on the horizon, just a slow, quiet descent.